Common Property Tax Exemptions

All Property Tax Exemption Applications and documentation must be turned in to the Assessor's Office by March 1st.

PDF

PDF

Download "RP-467 Application for Senior Citizens Exemption.pdf"

PDF

PDF

Download "RP-467-Rnw Renewal Application for Senior Citizens.pdf"

PDF

PDF

PDF

PDF

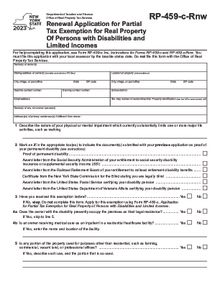

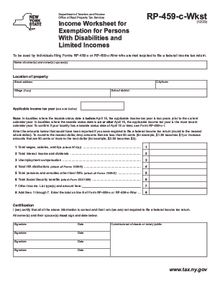

Download "RP-459-c Disabilities & Limited Income Application.pdf"

PDF

PDF

PDF

PDF

PDF

PDF

Download "RP-458-a Alternative Veterans Exemption Application.pdf"

PDF

PDF

PDF

PDF

Download "RP-466-a-vol Application for Volunteer Firefighters-Ambulance Workers Exemption.pdf"