FAQs:

Uniform Percentage of Value

The percentage of market value (full value) used by an assessing unit to establish uniform assessments. This value must appear on the tentative roll. Real Property Tax Law Section 305 specifies, "all real property in each assessing unit shall be assessed at a uniform percentage of value..."

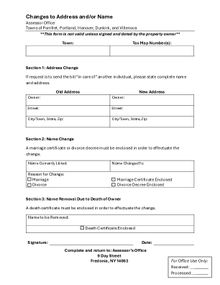

Taxable Status Date

The ownership and physical condition of real property as of this date are assessed (valued) according to price fixed as of the valuation date. All applications for property exemptions must be filed with the assessor by this date.

Residential Assessment Ratio (RAR)

A percentage established by the State Board of Real Property Services according to law, using the ratio of assessed value to the sales price for each usable residential sale in a recent one-year period. Ratios are then listed from highest to lowest; the midpoint (median) ratio is selected as the RAR. The RAR can be used to prove that a residential property is assessed at a higher level than other homes on the assessment roll. Your locality's RAR indicates at what percent of full value residential properties are assessed. For example, a RAR of 20 indicates that residential properties are assessed at approximately 20 percent of their full value.

Equalization Rate

"State equalization rate" means the percentage of full value at which taxable real property in a county, city, town or village is assessed as determined by the state board." (RPTL Section 102) The rate is a ratio of the sum of the locally determined assessed values for all taxable parcels for a given assessment roll divided by ORPS's estimate of total full value for that same roll.